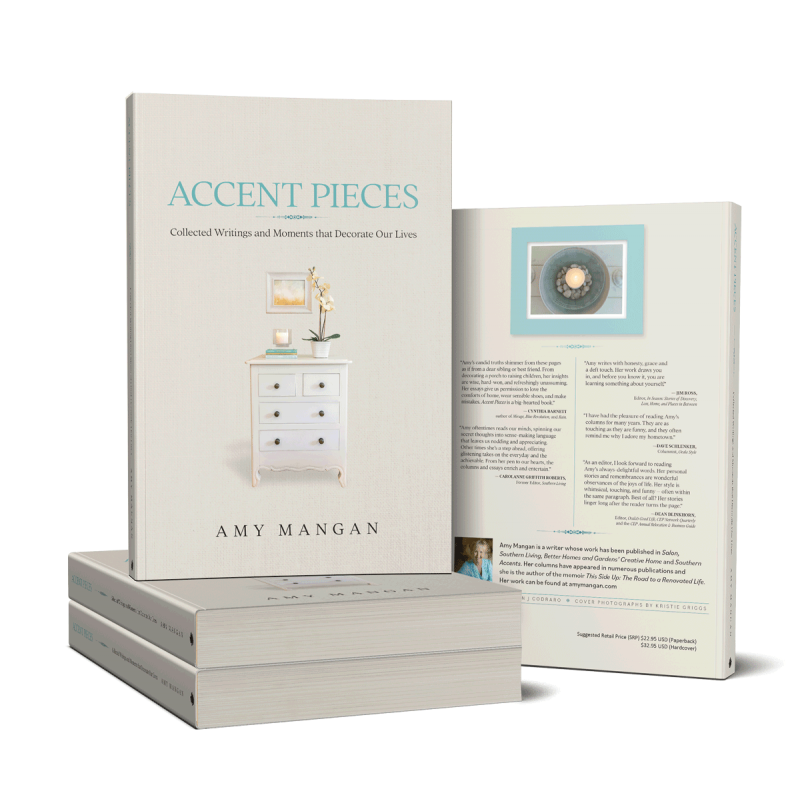

At a recent library discussion about my book, a memoir on a post-2008 recession life, someone asked me how I felt about our younger generation’s approach to money.

Funny she should ask because I spend a lot of time thinking about this. Maybe because I’ve come on the other side of recession-induced financial strife. Maybe because I’ve learned the value of always looking around corners, so to speak, that aren’t visible. Maybe because I’ve lost a lot and lived to tell the tale. Or maybe because I’ve birthed two millennials who saw, first-hand, the power of what money can do and what not having it can damage.

Already in this new year, there are signs of a changing U.S. economy with a jittery stock market. This got me thinking about our young adults and their relationship to money. In the spirit of knowing now what I wish I knew then, here’s my advice to young adults.

Dear Millennials,

I’m a little worried about you. As a survivor of the 2008 recession, I want to make sure you heed the warning signs for the next one. And, trust me, there will be a next one. I’ve raised two of you and taught even more as a former college professor. I’ve noticed some alarming trends for you and our nation. Allow me to connect the dots.

First, you’re making more money, but you’re spending more with a lot going to debt. All while our country is witnessing preliminary signs of inflation. Not a good combo. Student loans consume a big part of your paycheck for those of you who haven’t defaulted. Credit cards eat a chunk of disposable income, too.

Which leads me to another observation: You are saving less than you should. Before you respond in protest that much of your economic insecurity isn’t your fault, let me interrupt to wholeheartedly agree. You came into adulthood with the financial baggage of your predecessors, also known as parents. You didn’t pick this battle, but you’re in it.

It’s not a surprise you’re anxious. In a recent Bankrate survey, 77 percent of you say you are the most stressed-out age group. You lose sleep over your financial instability. I do, too. I’ve been in your shoes. Actually, I’m kind of responsible for your debt-ridden shoes. Please forgive me. I’d do anything to eradicate the question marks stalking your future.

Which is why you’re getting this letter.

Learn from my mistakes. I didn’t save enough. I gave up a good job for an unstable one based on passion instead of security. My husband did, too. Before 2008, the economy was strong with an equally robust housing market. Until it wasn’t.

We both lost our jobs. We didn’t save enough when the recession earthquake leveled us. Since then, we’ve clawed our way back. Our American dream became more like an American wish. Much like yours. I get it.

So, here is what you can do. Re-think that expensive downtown rental for a cheaper one in a different part of town. Start a modest savings account. Pay down your debt, which may mean renegotiating the terms. You have head-strong resolve. I’ve seen it firsthand. You are creative, whip smart, industrious, idealistic and a tad stubborn. These traits will serve you well.

My husband and I have been fortunate to course-correct. We’ve taken steps to ensure we’re ready when the next economic storm comes. So, please learn not only from our mistakes, but also from our response to them. I want you to be financially able to take care of yourself. So, one day, you’re not writing a letter to me asking for help.

Sincerely,

Someone who has been there, done that